how to find out why i have a tax levy

Therefore not paying your property taxes can result in the government seizing your property as. As You Can See Releasing A Tax Lien Has A Multitude Of Nuances And Variables To Consider The Actions And Strategies Are Depe Tax Debt Debt Help Debt Reduction In.

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Immediate Permanent Solutions.

. Free Case Review Begin Online. If you fail to pay what you owe and you dont take steps to resolve it the second requirement. See If You Qualify For IRS Fresh Start Program.

Trusted Affordable Reliable Professionals That Can Stop Your Tax Levy Today. Ad Stop Tax Levy. The IRS and state tax authorities have the power to seize the money in your bank account take a portion of your wages directly out of your paycheck and levy many other types of property.

For starters the IRS will assess the tax amount you owe. The first is to assess the tax you owe and send a Notice and Demand for Payment. Get Free Consult Quote.

Every time you get paid. June 6 2019 625 AM. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets.

How do I know if I have a tax levy. A property tax levy is the right to seize an asset as a substitute for non-payment. It is different from a lien while a lien makes a claim to your assets as.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. The IRS may give you this notice in. This is called a substitute.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. The IRS sent you a Final Notice of Intent to Levy and Notice of Your Right to A Hearing levy notice at least 30 days before the levy. This is done when you file a tax return stating the money you owe or the IRS will do so for you.

A tax lien will typically show up on your credit report which can make it very hard to buy property get a credit card or handle basic needs like getting a car. It can garnish wages take money in your bank or other financial account seize and sell your vehicle. A simple solution is to open up a separate bank account put your name on it and ask the bank to title the account as an Estimated Tax Account.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Free Case Review Begin Online. You may also have a.

See If You Qualify For IRS Fresh Start Program.

Hong Kong S Tax System Explained Why Levies Are So Low How It Competes With Singapore And Why It S Both Out Of Date And Ahead Of Its Time South China Morning Post

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

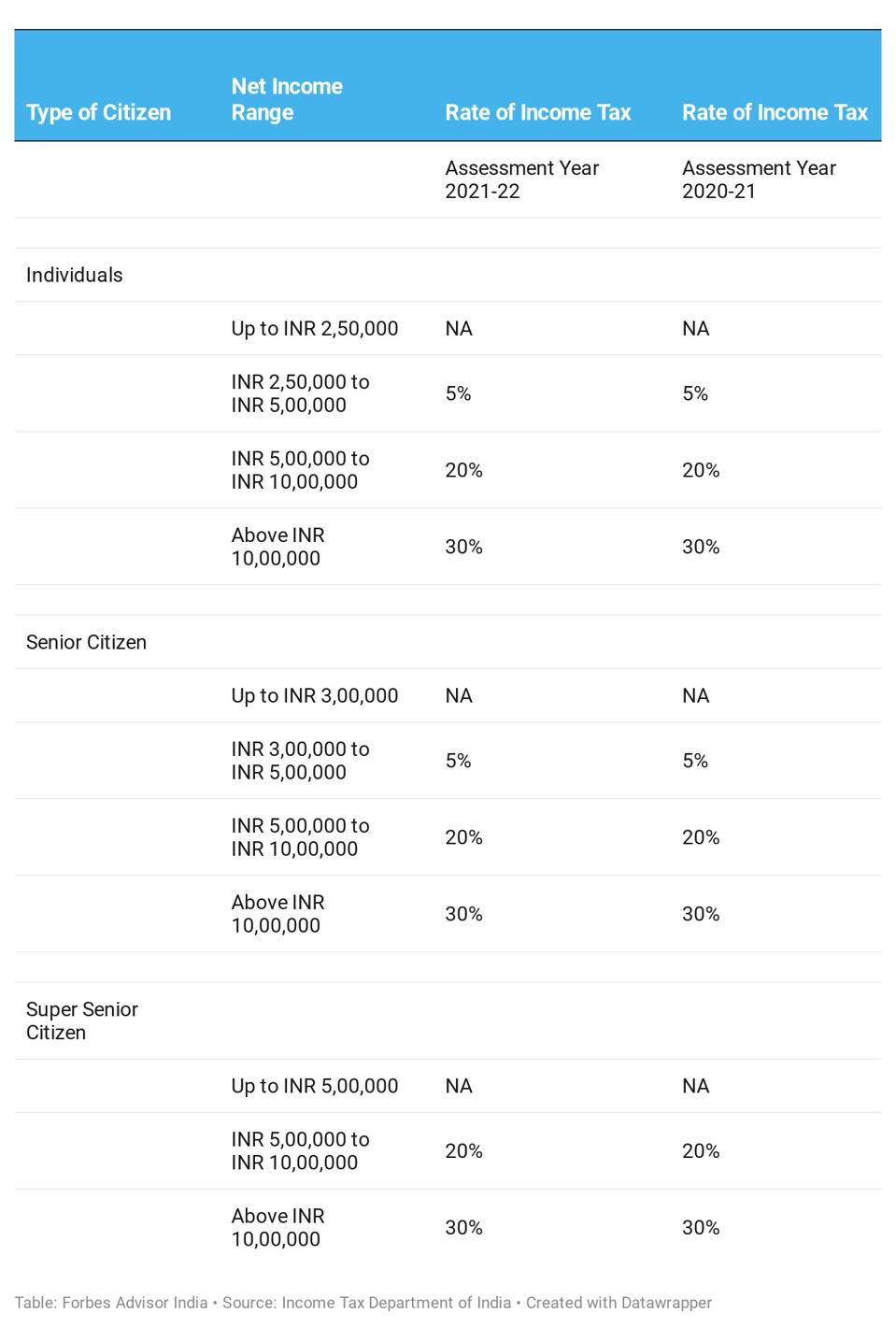

Know Types Of Direct Tax And Charges Forbes Advisor India

4 7 Taxes And Subsidies Principles Of Microeconomics

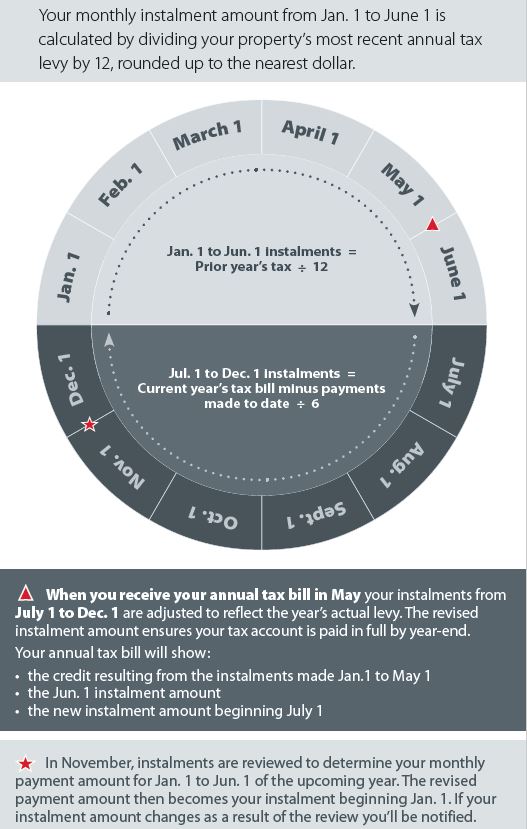

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Tax Levy Understanding The Tax Levy A 15 Minute Guide

What Is A Tax Levy Guide To Everything You Need To Know Ageras

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Tax Levy Understanding The Tax Levy A 15 Minute Guide

This Tax Brings In Billions Worldwide Why There S No Vat In The U S

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Can The Irs Take Money From My Bank Account Manassas Law Group