st louis county sales tax calculator

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Monday - Friday 8 AM - 5 PM.

Rate Commission Metropolitan St Louis Sewer District

Sales taxes are another important source of revenue for state and local governments in Missouri.

. The total sales tax rate in any given location can be broken down into state county city and special district rates. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. The latest sales tax rate for Saint Louis MO.

2020 rates included for use while preparing your income tax. This includes the rates on the state county city and special levels. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05. Louis County local sales taxesThe local sales tax consists of a 050. Louis County Minnesota sales tax is 738 consisting of 688 Minnesota state sales tax and 050 St.

The current total local sales tax rate in Saint Louis County MO is 7738. Missouri has a 4225 statewide sales tax rate but. The sales tax rate for Saint Louis County was updated for the 2020 tax year this is the current sales tax rate we are using in the.

Bond Refund or Release Request. Motor Vehicle Trailer ATV and Watercraft Tax Calculator. 6101 Southwest Ave St Louis.

Sales tax in Saint Louis County Missouri is currently 761. Additions to Tax and Interest Calculator. 41 South Central Avenue Clayton MO 63105.

Missouri has a 4225 sales tax and St Louis County collects an. This rate includes any state county city and local sales taxes. Download all Missouri sales tax rates by zip code.

The Missouri state sales tax rate is currently. Minnesota has a 6875 sales tax and St Louis County collects an. Homes similar to 1907 Forest Ave are listed between 58K to 405K at an average of 210 per square foot.

The Missouri statewide rate is 4225 which by itself. The average cumulative sales tax rate in Saint Louis Missouri is 1024 with a range that spans from 774 to 1168. Missouri Sales Tax.

The December 2020 total local sales tax rate was 7613. Louis County local sales. Their website states You must pay the state sales tax AND any local taxes of the city or county where you live not.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local. The minimum combined 2022 sales tax rate for St Louis County Missouri is. This is the total of state and county sales tax rates.

The Missouri DOR is the agency authorized to assess and collect the monies.

1 125 Sales Tax Calculator Template

The Non Profit Paradox 40 Of Real Estate In St Louis Is Government Owned Or Tax Exempt Nextstl

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Proposition P Lake Saint Louis Mo

How To Calculate Cannabis Taxes At Your Dispensary

![]()

County Assessor St Louis County Website

County Assessor St Louis County Website

Six Economic Facts On International Corporate Taxation

Property Tax By County Property Tax Calculator Rethority

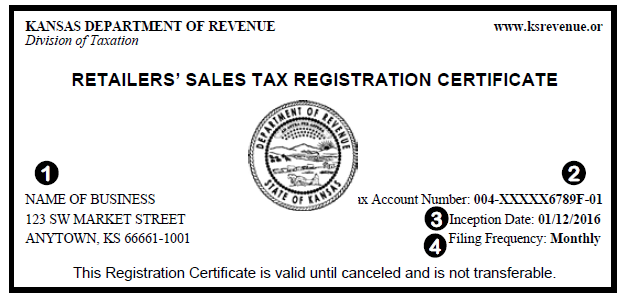

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

Sales Tax Calculator And Rate Lookup Tool Avalara

Missouri 2022 Sales Tax Calculator Rate Lookup Tool Avalara

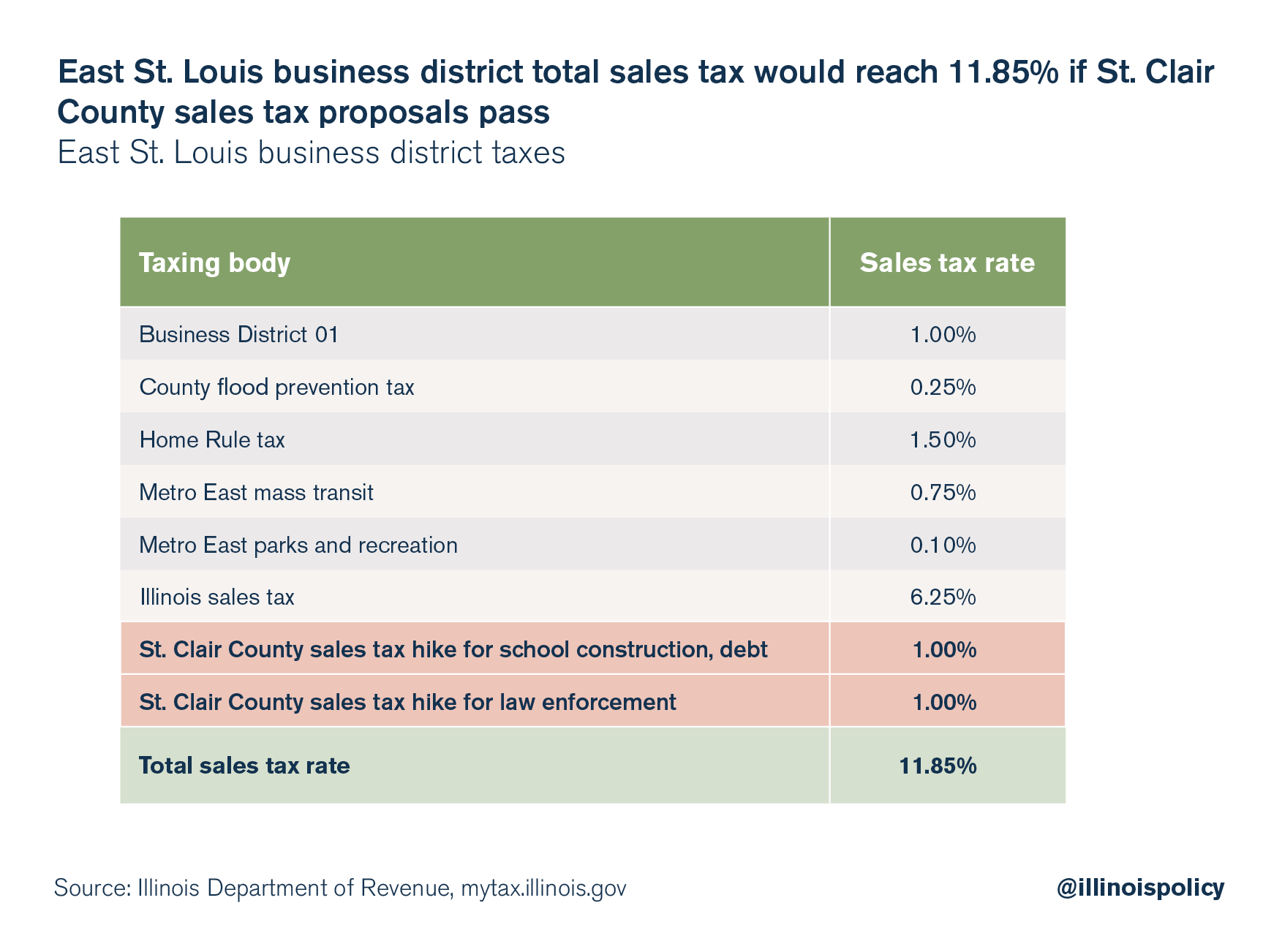

Many St Clair County Residents Would Face Higher Sales Tax Rates Than Chicago If Sales Tax Proposals Pass

E Commerce And Sales Taxes What You Collect Depends On Where You Ship Oklahoma State University

10 Best Places To Live In Missouri For Democrats And Republicans

Tax Rates Creve Coeur Mo Official Website

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price